National Insurance Contributions : National Insurance Contributions Explained Ifs Taxlab

Why Fidelity National Title. Increasing national insurance by 1p for employees and the self-employed would raise around 6bn a year according to calculations by the Resolution Foundation.

Tolley S National Insurance Contributions 2019 20 Main Annual Ashall Vince 9780754556077 Amazon Com Books

There is a vast difference in the way National Insurance contributions for employed and the self employed is calculated.

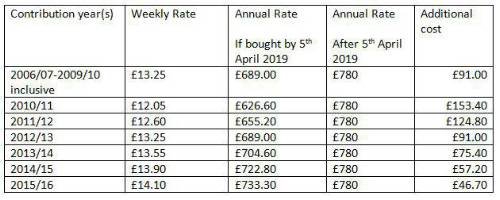

National insurance contributions. The purpose of paying voluntary national insurance contributions is to secure entitlement to various UK National Insurance benefits like basic State Pension. The contributions are made through payroll. Free online quotes for the insurance coverage you want.

The law supports this goal through the creation of a number of provisions that help promote employer-sponsored health insurance in their own specific ways. Their employers contribute 71 percent on their behalf for a total of 88 percent. The second Class 1A or 1B are payments that you must make directly as the employer.

National General Insurance offers Auto RV and Home Insurance. National Insurance contributions also popularly known as NIC is calculated on the basis of your employment status and your earnings. They range from the creation of tax credits for.

Hunt who chairs the. Employed persons who earn less than 60 per week pay contributions at the rate of 17 percent of their wages. 184 to 967 a week 797 to 4189 a month 12.

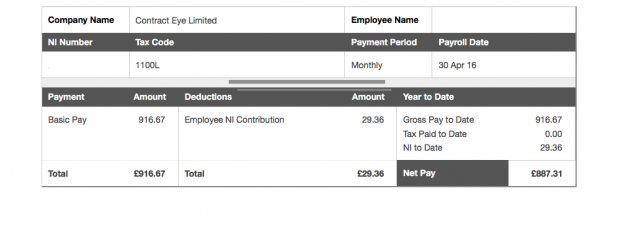

We are dedicated to a positive attituted that reflects the value of our customers and employees. Theyre automatically deducted by. Any National Insurance costs are taken as a percentage provided that your salary is above 184 each week or 9568 per year.

The first Class 1 are contributions deducted from their pay by you the employer. It has agreements with Reciprocal Agreement Countries and European Economic Area EEA regarding special benefits. If you earn between 120 and 184 a week your contributions are treated as having been paid to.

The Prime Minister in her Budgetary Proposal and Financial Statement in June 2018 introduced a Health Service Contribution at a rate of 25 to which employers are required to contribute 15 of insurable earnings and 10 by employees and self-employed persons. Insurance a key component of which is the promotion of private employer-based health insurance. National Insurance contributions If youre employed you pay Class 1 National Insurance contributions based on your level of earnings.

The public is advised that full walk-in services will resume at all Service Centres Wednesday 1st September 2021 from 800 am to 300 pm. Youre a married woman or widow with a valid. Employed persons who earn from 60 per week up to the weekly insurable.

An employees National Insurance payments comprise two elements. We are dedicated to a supportive environment that promotes and recognizes our employees. National Insurance Contributions will be taken from your overall income though unless you have already reached the state pension age.

We are dedicated to the development of quality products and services that anticipate and respond to our customers changing needs. Youll pay less if. Income Tax Bands.

Over 967 a week 4189 a month 2. Class 1 National Insurance rate. Contributions payable by an employer in respect of employment injury coverage for an employed person who has not yet attained the age of 16 years or who is in receipt of retirement pension or who has attained the age of 65 years shall be as set out in Class Z or.

National Insurance Contributions NIC are taxes paid by British employees and employers to fund government benefits programs including state pensions. You need a National Insurance number before you can start paying National Insurance contributions.

National Insurance Contributions Complete Guide And Faq

Should I Be Paying National Insurance Contributions On My Private Pension

National Insurance Contributions Explained Ifs Taxlab

Do You Have A Gap In Your National Insurance Record

Workers Urged To Top Up State Pension Now To Avoid Cost Rise

National Insurance Contributions Explained Ifs Taxlab

National Insurance Contributions What Yacht Crew Need To Do

National Insurance Contributions Benefitting With Form P9d

Class 2 National Insurance Contributions To Remain Sibbalds Chartered Accountants Derby

National Insurance Contributions Nic Acca Taxation Tx Uk Youtube

How To Check Your National Insurance Contributions Record Holborn Assets Holborn Assets

National Insurance Contributions Explained Ifs Taxlab

Uk National Insurance As An Expat Experts For Expats

Understanding The National Insurance Contributions System Certificate Cudoo

National Insurance For Limited Company Contractors It Contracting

Check Your National Insurance Contributions Online

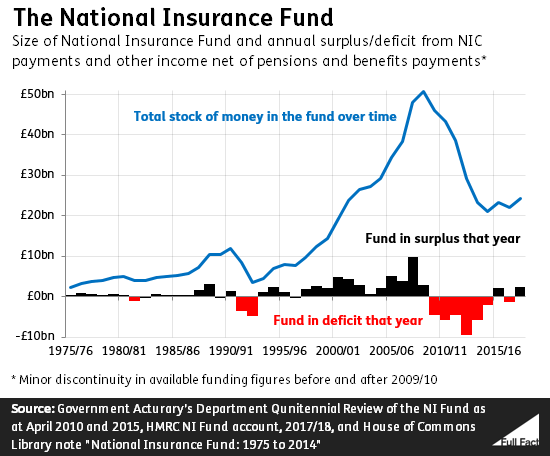

What Happens To The Money From National Insurance Contributions Full Fact

How To Check Your National Insurance Contributions Record Holborn Assets Holborn Assets

Property118 Class 2 National Insurance Contributions Property118